If you are looking for a reliable, efficient, and innovative financial partner for your business account, GCB Bank got you. GCB Bank is a leading bank in Africa, with rich history, clear vision, strong performance, and a culture of innovation. The bank offers a range of products and services that cater to the needs and expectations of its customers and create value for business accounts. It’s also a socially responsible corporate citizen, contributing to the social and economic development of the communities.

Here are some of the reasons why you should choose GCB Bank for your business operations:

Unrivalled Experience and Expertise

GCB Bank has over 70 years of commitment to encouraging and supporting business growth in Ghana. It has the experience, understanding, and knowledge to meet the diverse and complex needs of different types of businesses. From startups, sole traders, and entrepreneurs, to small and medium enterprises, and national and international corporations, GCB has been there.

GCB Bank has a team of experienced professionals who go extra miles to ensure all your business needs are met. GCB Bank also provides business advice, relationship management, business development, and customer services to help you achieve your business goals.

Variety of Products and Services

GCB Bank offers everything you could need in a financial partner, with a variety of products and services, including:

Business Accounts

- Current accounts: The Business Account makes it convenient for you to make payments and have access to cash using checks. Other acceptable means. You also get a free business debit card, no limit on deposits, monthly statements, and instant mini-statements. You get free access to e-banking channels as well.

- Savings accounts: GCB Bank offers attractive interest rates and flexible terms on its savings accounts. They include the GCB Savings Plus Account, the GCB Fixed Deposit Account, and the GCB Link2Home Account. You can save at home while abroad, earn high returns on your deposits, and enjoy easy access to your funds.

- Loans: GCB Bank provides various loan products to suit your business needs. GCB Easy Pick, the GCB 24hr Loans, the GCB Trade Finance, and the GCB Overdraft Facility are available loan options. You can get a personal loan just in time when you need it, buy the things you love now and pay later, finance your import and export activities, and manage your cash flow fluctuations.

Other services

- Money transfer: GCB Bank enables you to receive and send funds from any location around the globe, using its fast, secure, and convenient money transfer services, such as the GCB SWIFT, the GCB Western Union, the GCB MoneyGram, and the GCB RIA.

- Payroll solutions: GCB Bank helps you to manage your payroll efficiently and effectively, with its GCB Payroll Solutions. You can pay your employees on time, reduce errors and fraud, and comply with tax and regulatory requirements.

- Bulk cash collection: GCB Bank offers a safe and convenient way to collect your cash from your business premises, using its GCB Bulk Cash Collection service. You can save time and money, reduce the risk of theft and robbery, and improve your cash flow management.

Innovation and Technology

The Bank is constantly innovating and upgrading its technology to provide you with the best banking experience. GCB Bank has upgraded its core banking system, enhanced its internet and mobile banking platforms, and introduced new products and services, such as:

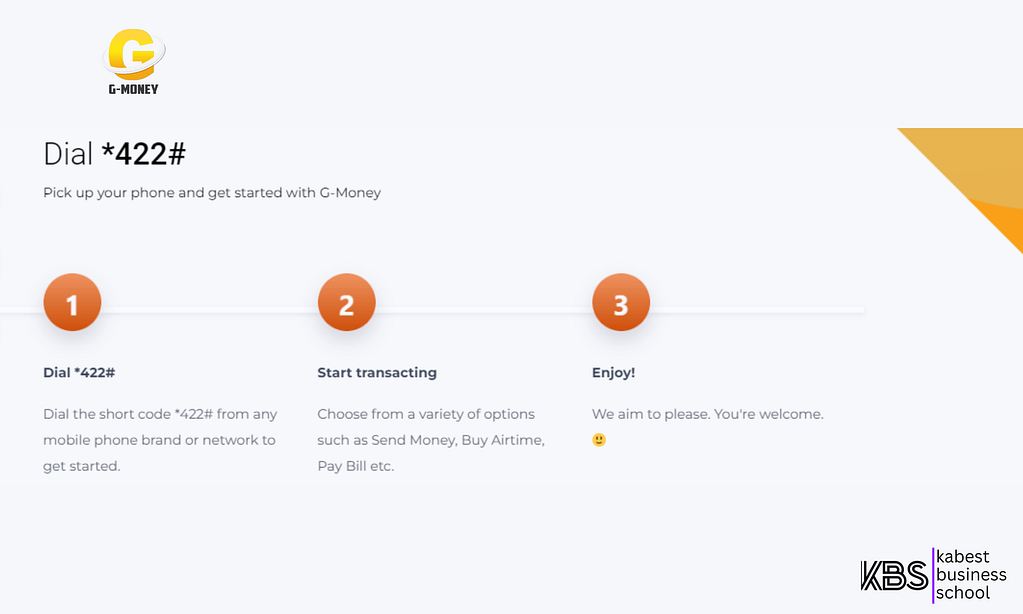

- G-Money: G-Money is a mobile money service that allows you to store, send, and receive money using your mobile phone. You can also pay bills, buy airtime, shop online, and access other financial services.

- LitePay: LitePay is a mobile point of sale device that allows you to accept payments from your customers using their debit or credit cards, mobile money, or QR codes. You can also generate receipts, track sales, and manage inventory.

- Easy Pick: Easy Pick is a buy now, pay later service that gives you financial access to buy the things you love from selected vendors, and pay in installments over a period of time. You can also enjoy discounts, rewards, and free delivery.

Ghana commercial Bank also uses artificial intelligence, biometric authentication, and blockchain technology to enhance its security, efficiency, and customer satisfaction.

Social Responsibility and Sustainability

GCB Bank is not only a profitable and successful bank, but also a socially responsible and sustainable one. GCB Bank contributes to the social and economic development of the communities it serves, and protects the environment, through its various initiatives, such as:

- GCB Foundation: GCB Foundation is the corporate social responsibility arm of GCB Bank, which supports projects in the areas of education, health, water and sanitation, sports, and culture. Some of the projects include building schools, hospitals, boreholes, libraries, and sports facilities, as well as sponsoring scholarships, awards, festivals, and competitions.

- GCB Green: GCB Green is the environmental sustainability program of GCB Bank, which aims to reduce its carbon footprint, conserve natural resources, and promote green practices. Some of the activities include planting trees, using solar energy, recycling waste, and encouraging paperless banking.

Opening a GCB business account

You may wish to use your personal bank account for your business or start up. But there are a number of good reasons that should encourage you to get a separate account for your business. Although personal and business accounts are similar but to get a business account requires a business certifications. I’ve listed some benefits you’ll get if you open a business account with GCB bank.

Key benefits of holding GCB business account

- Always convenient for business transactions

- Get free business debit card

- There is no limit on deposits

- Get monthly account statement

- Convenient means to access cash using check.

- Instant mini-statements available at ATMs

- Access to free e-banking

- Be able to monitor and check the cashflow of your business

- Your funds are in safer hands.

Application requirements for SMEs business account

- Certificate of incorporation

- Certificate to commence business

- A copy of company regulations

- Resolution from Board of Directors

- Certificate of registration

- Registration of Business Act (Form A)

- Two passport-sized photographs

- Valid identity card (passport / driver’s license / voter ID)

- Letter of introduction from an existing GCB current account holder / solicitor / auditor

- Residential and business postal addresses

- An initial deposit

As you can see, GCB Bank is the best choice for your business, as it offers you a range of benefits, such as unrivalled experience and expertise, variety of products and services, innovation and technology, and social responsibility and sustainability. GCB Bank is more than just a bank, it is a partner for your business success.

So, what are you waiting for? Join GCB Bank today and enjoy the best business banking experience in Africa. Visit GCB or any of their 185 branches nationwide to open an account or learn more about their products and services.