Did you know that nearly 82% of businesses go out of business due to poor cash flow management? Successful companies can even fall into financial trouble with poor planning for cash flow.

Here, in this article, we will explore in detail the fundamentals of cash flow management, why it is critical for a successful and long-term business, and how you can implement actionable tips for a healthy liquidity position.

- What is cash flow and why it matters

- Key components of effective cash flow management

- Real-life examples and actionable strategies

- Tools and resources to help streamline your cash management

What is Cash Flow?

Cash Flow refers to the movement of money in and out of a business, organization, or individual’s finances over a specific period. It represents how cash is generated (inflows) and spent (outflows), affecting liquidity and financial stability. It consists of:

- Cash Inflows (money received from sales, loans, or investments)

- Cash Outflows (money spent on expenses, salaries, and operations)

- Net Cash Flow (the difference between cash inflows and outflows, determining liquidity)

This technical business tool must always form part of your business plan, and when planning on how to set your SMART goals for your business.

Positive Cash Flow

Positive cash flow occurs when a company realizes a larger inflow of cash than outflows over a sustained period. The company maintains a high liquidity level to settle its expenses, finance expansion, and build financial solidity.

Benefits of Positive Cash Flow:

- Ensures timely payment of bills, suppliers, and employees.

- Includes room for reinvesting in the expansion of the business.

- Increases financial security and credit rating of the business.

- Enables freedom to seize new opportunities, for example, purchasing goods in bulk at discounts.

- Reduces dependence on external funding, for example, loans and credit lines.

Example of Positive Cash Flow:

A software company launches a subscription service in which buyers pay an annual subscription fee in advance. As a result, the company realizes a steady inflow of cash with operational expenses under control, generating a pool of cash for investing in marketing and new product development.

Negative Cash Flow

A position in which a company’s outflows of cash outbalance its inflows, generating a shortage of funds, is a case of negative cash flow. Perpetuated over a long duration, such a position can generate financial strain, delayed payments, and even bankruptcy.

Reasons for Negative Cash Flow:

- Slow payments received from customers and long payment terms.

- High operational and overhead expenses.

- Ineffective inventory management, generating unsold stocks.

- Use of credit with no payment schedule in consideration.

- Surprise expenses and downturns in the economy.

Impacts of Negative Cash Flow:

- Inability to pay your workers and your suppliers, generating operational dislocations.

- Accumulation of debts through taking loans to cover gaps.

- Risk of missing out on a business opportunity for lack of funds.

- A decline in investors’ and lenders’ confidence, with difficulty in raising funds in the future.

Example of Negative Cash Flow:

A retail store spends a lot on opening new stores with no assurance of sustained sales growth. As expenses rise (rent, salaries, and inventories), sales don’t increase at a similar level. This generates a cash shortage, and the store takes high-interest loans, deepening its financial position even further.

Key Components of Cash Flow

Understanding the key components of cash flow helps business owners make informed financial decisions.

- Cash Inflows: Revenue from product or service sales, customer payments, loans, grants, or investments.

- Cash Outflows: Payments for rent, salaries, utilities, inventory purchases, loan repayments, and taxes.

- Net Cash Flow: The difference between cash inflows and outflows, which determines liquidity.

A business’s cash flow is impacted by several factors, including:

- External market conditions

- Revenue cycles

- Payment terms

- Operational expenses

Understanding the key components of cash flow helps business owners make informed financial decisions.

- Cash Inflows: Revenue from product or service sales, customer payments, loans, grants, or investments.

- Cash Outflows: Payments for rent, salaries, utilities, inventory purchases, loan repayments, and taxes.

- Net Cash Flow: The difference between cash inflows and outflows, which determines liquidity.

Strategies for Managing Cash Flow

Managing cash flow requires strategic planning. Businesses should implement forecasting tools to predict future cash movements and identify potential shortfalls in advance.

Setting up a cash reserve can help cushion financial shocks, ensuring that operational expenses are covered even during slow revenue periods.

Improving Cash Inflows

One way to improve cash inflows is to streamline accounts receivable. Discounts, automated invoicing, and clear payment terms can encourage customers to pay early, reducing late payments and enhancing liquidity. Additionally, diversifying revenue sources—such as offering new products, services, or subscription models—can create a more predictable cash flow.

Controlling Cash Outflows

Controlling cash outflows is equally important. Negotiating better payment terms with suppliers, cutting unnecessary expenses, and optimizing inventory management can significantly reduce cash shortages. Businesses should regularly review expenses and eliminate inefficiencies to maintain profitability.

Real-World Examples

Real-world examples show how businesses have turned around their cash flow situations through proper financial planning. A small retail store, for instance, faced frequent cash shortages due to slow customer payments. By implementing a digital invoicing system and offering early-payment discounts, the store reduced payment delays by 30%, resulting in improved liquidity and better inventory management.

Tools for Effective Cash Flow Management

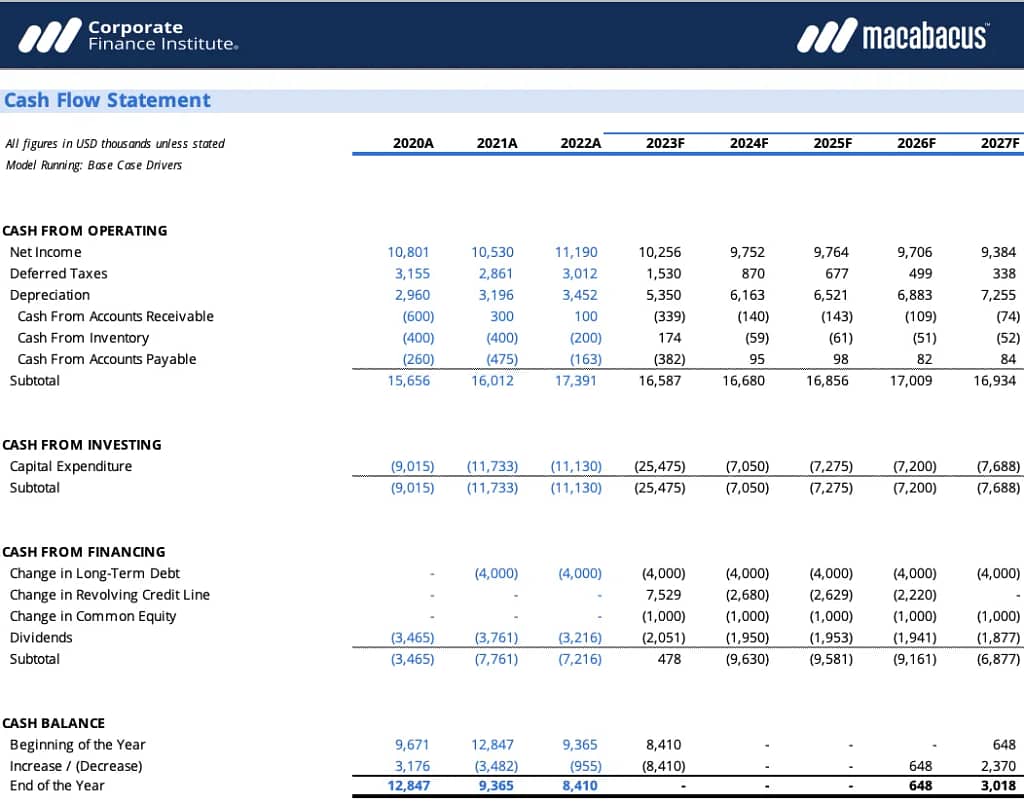

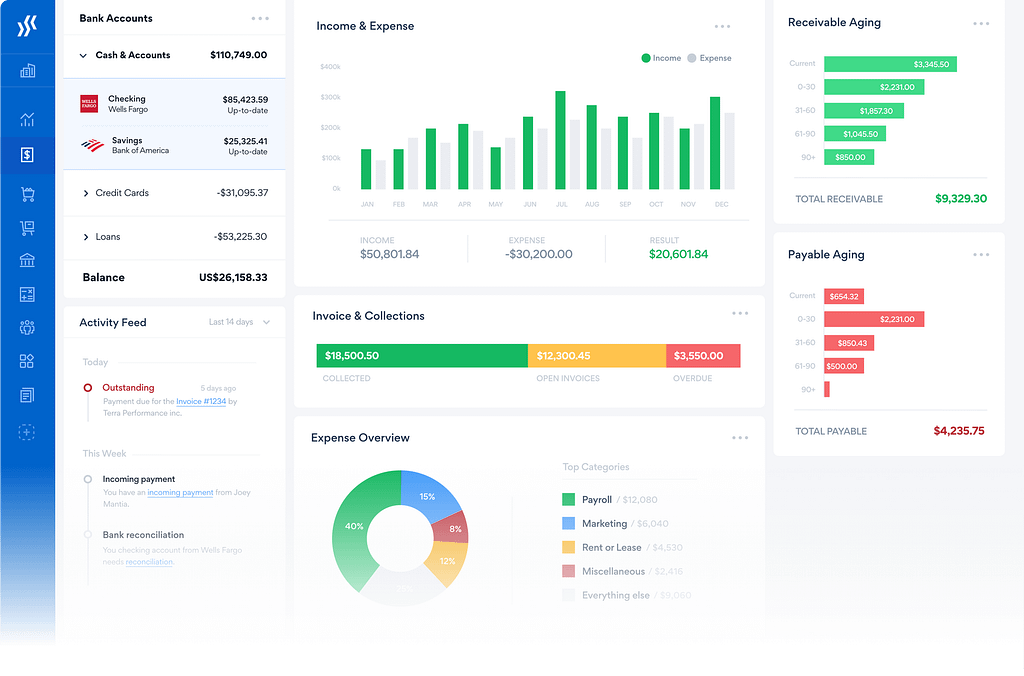

For accurate cash flow management, businesses should use financial tools and software like:

These platforms help track transactions, generate cash flow statements, and forecast future trends, allowing business owners to make proactive financial decisions.

Common Mistakes to Avoid

A common mistake businesses make is focusing only on profitability rather than liquidity. While profitability is essential, cash flow ensures the business can operate smoothly.

For instance, a company may have high sales revenue but face bankruptcy due to excessive outstanding invoices and unpaid bills. Maintaining a balance between profitability and liquidity is crucial for long-term success.

Reviewing and Adjusting Cash Flow Strategies

Regularly reviewing cash flow statements helps business owners detect trends and make necessary adjustments. Monthly or quarterly cash flow analysis provides insights into where money is going and highlights areas for improvement.

Businesses should aim to maintain positive cash flow by aligning expenses with revenue patterns and adjusting their strategies accordingly.

Conclusion

Effective cash flow management can be the difference between business success and failure. By forecasting cash movements, streamlining receivables, managing payables strategically, and using the right financial tools, businesses can achieve financial stability and sustainable growth.

Staying proactive and continuously improving cash flow strategies ensures businesses can navigate economic uncertainties and remain competitive in the long run.