Start investing

You may wonder why the topic “How to Start Investing and Growing Your Wealth”? Well, let us be honest here. Do you ever realize that you have sometimes been stacked in a cycle of living paycheck to paycheck, struggling to make ends meet, or worrying about your financial future? You are not the only person on this what I call an “alarming journey.” Our world these days is filled with many people who find themselves facing financial complications, whether it is due to rising living costs, motionless earnings, or unplanned expenses.

The idea of growing wealth through investing might seem intimidating or out of reach, especially if you are not sure where to begin or if you have encountered negative experiences with financial institutions in the past. Nevertheless, the reality of the matter is that with the right knowledge and approach or method, anyone can begin their journey toward financial independence and security. Did you not know?

This article is a comprehensive one and it will take you through the essential steps of starting investments and growing your wealth either from scratch or improving what you have started. From understanding the basics of investing to developing a personalized strategy tailored to your financial goals, this piece will empower you to take control of your future finances and build the wealth you deserve. Take a critical note and make every point count because it is meant to solve your financial problems.

Understanding the Basics of Investing

According to Google search results, investing is “to put (money) into financial schemes, shares, property, or a commercial venture with the expectation of achieving a profit” over time. At the core of investing, it involves putting money into assets with the expectation of generating a profit. These assets can include stocks, bonds, real estate, and commodities, among others. The primary goal of investing is to grow your wealth over the long term, outpacing inflation and achieving financial security and financial stability.

If you want to consider investments, it is important to understand the concept of risk and return. Investments with higher potential returns also come with higher levels of risk to the highest level of even losing the entire funds you put into the investment. Mathematically, we say that potential returns on investment are directly proportional to the risk involved. It means if your risk increases by 10%, your potential return will also increase by 10%. For example, stocks have historically offered higher returns than bonds or savings accounts, but they also carry greater volatility and the potential for loss. Are you threatened by this? Is investing worth your money? Let us explore together.

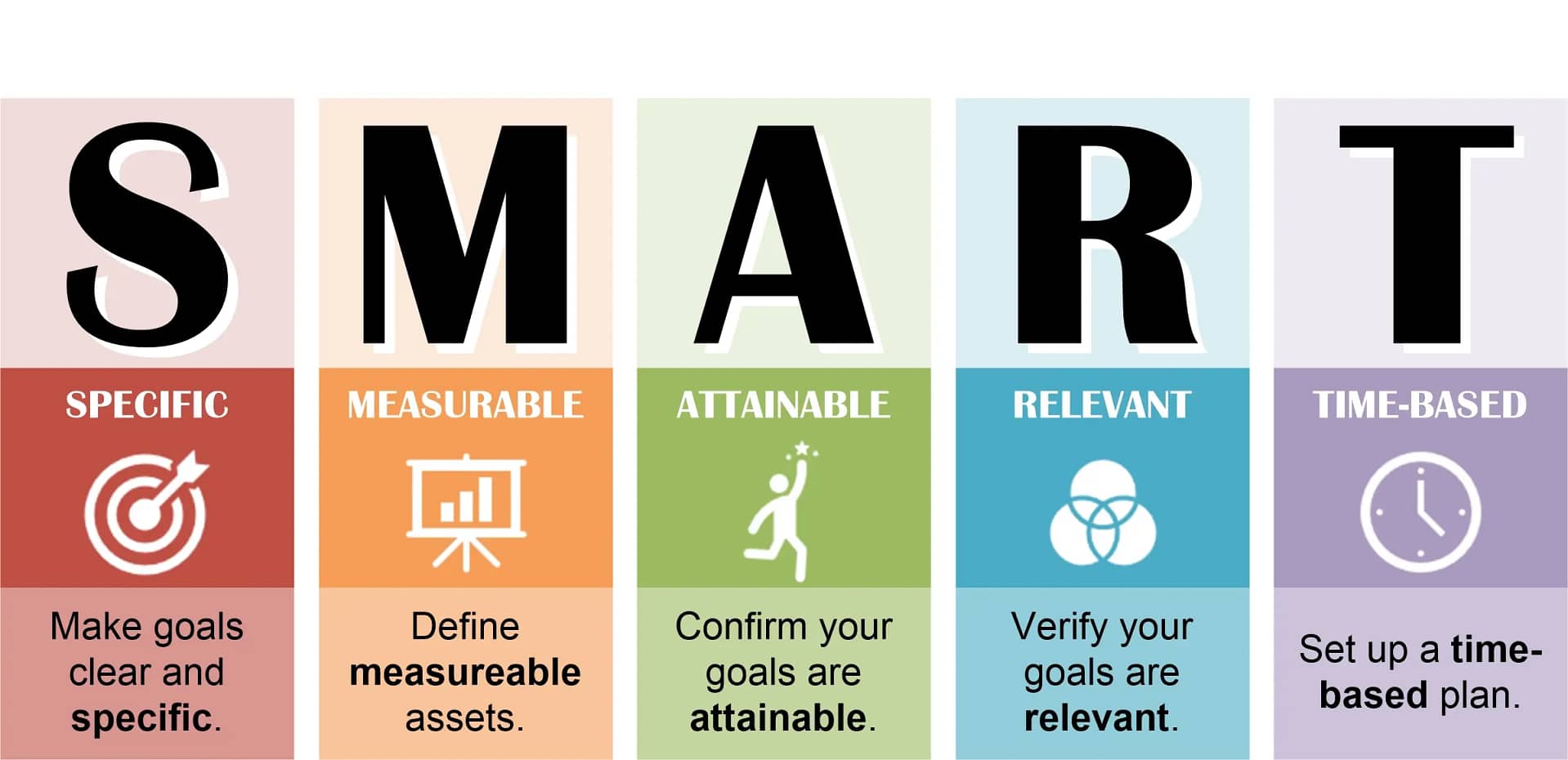

To start your investment journey, it is essential to establish well-defined financial goals that are easily achievable. Whether you are saving for retirement, a down payment on a mortgage, or to finance your children’s education, having specific objectives will guide your investment decisions and help you stay focused on your long-term vision.

Start Investing Right: Building a Strong Financial Foundation

To start investing, you must have a solid foundation in terms of financial discipline and possess key characteristics of wealth handling, with this, you can achieve a lot. The following are some characteristics you can build upon.

Budgeting and Saving:

Budgeting is the first thing that comes to mind if you want to start investing. It is the foundation stone of financial stability. Budgeting involves tracking your income and expenses to ensure that you are living within your means and prioritizing your financial goals. To do this you have to start by listing all sources of income and then categorizing your expenses into essentials (such as housing, food, clothing and transportation) and discretionary spending (such as entertainment and dining out). You can use budgeting tools or apps such as budget planner to help you track your spending and identify areas where you can cut back or save more.

Once you have a budget in place, you must focus on building a habit of saving. Aim to set aside a portion of your income each month for savings and investments. Start with a small percentage, such as 10%, and gradually increase it as your financial situation improves. You can consider automating your savings by setting up automatic transfers from your checking account to a savings or investment account. This can help you stay disciplined and consistent with your saving habits and as you know your accumulated habits will become your character. This character will lead you to build a successful financial future.

Emergency Fund:

An emergency fund is a crucial component of financial security. It acts as a safety net, providing you with funds to cover unexpected expenses or financial emergencies, such as medical bills or car repairs, without having to rely on credit cards or loans. Aim to save at least three to six months’ worth of living expenses in your emergency fund, although the exact amount may vary depending on your circumstances and risk tolerance.

To build your emergency fund, prioritize saving a portion of your income each month until you reach your target amount. Consider keeping your emergency fund in a high-yield savings account or a money market fund that offers easy access to your funds while also earning a competitive interest rate. Avoid the temptation to dip into your emergency fund for non-essential expenses and replenish it as soon as possible if you do need to use it.

Paying Off Debt:

Debt can be a significant obstacle to building wealth, as it can eat into your income through interest payments and fees. Prioritize paying off high-interest debt, such as credit card balances or personal loans, as quickly as possible. Consider using strategies such as the debt snowball method, where you focus on paying off the smallest debt first while making minimum payments on larger debts, or the debt avalanche method, where you prioritize paying off debts with the highest interest rates first.

Once you have paid off high-interest debt, shift your concentration to other forms of debt, such as student loans or mortgages. Explore options for refinancing or consolidating your debt to lower your interest rates and monthly payments. By reducing your debt burden, you will free up more income to save and invest for the future, putting you on a path toward long-term financial success.

Developing an Investment Strategy

Risk Tolerance and Time Horizon:

Just as we mentioned in the introduction, understanding your risk tolerance and time horizon is essential for developing an investment strategy that aligns with your financial goals and comfort level. Risk tolerance refers to your willingness and ability to endure fluctuations in the value of your investments. How much of your money are ready to lose? Weigh up factors such as your age, financial situation, investment knowledge, and emotional temperament when assessing your risk tolerance. Younger investors with a longer time horizon can afford to take on more risk, as they have more time to recover from market downturns.

Your time horizon refers to the length of time you expect to hold your investments before needing to access the funds. Short-term goals, such as buying a house or funding a vacation, typically have a shorter time horizon and may require more conservative investment strategies to minimize the risk of loss. In contrast, long-term goals, such as retirement planning, allow for a more aggressive investment approach, as you have more time to ride out market fluctuations and benefit from the power of compounding returns.

Asset Allocation:

Asset allocation is the process of dividing your investment portfolio among different asset classes, such as stocks, bonds, and cash equivalents, to achieve a balance between risk and return. The goal of asset allocation is to create a diversified portfolio that can weather market volatility and generate consistent returns over time. Research has shown that asset allocation is the primary driver of investment performance, accounting for up to 90% of a portfolio’s variability in returns.

When determining your asset allocation, consider factors such as your risk tolerance, time horizon, and financial goals. A common rule of thumb is to subtract your age from 100 to determine the percentage of your portfolio that should be allocated to stocks, with the remainder allocated to bonds or other fixed-income investments. For example, if you are 30 years old, you might allocate 70% of your portfolio to stocks and 30% to bonds. As you approach retirement age, you may gradually shift towards a more conservative asset allocation to preserve capital and reduce volatility.

Diversification:

Diversification is another key principle of successful investing. It involves spreading your investments across different asset classes, industries, geographic regions, investment styles and even starting a new business to reduce the impact of any single investment on your overall portfolio. Diversification can help mitigate risk by ensuring that a decline in one asset or sector is offset by gains in others, thus smoothing out the overall volatility of your portfolio.

There are several ways to achieve diversification in your investment portfolio. You can invest in mutual funds or exchange-traded funds (ETFs) that hold a diversified mix of stocks, bonds, or other assets. Alternatively, you can build a diversified portfolio of individual securities by selecting investments across different sectors and industries. Regularly rebalancing your portfolio to maintain your target asset allocation can also help ensure that your investments remain diversified and aligned with your long-term goals.

Investment Vehicles:

There are numerous investment vehicles available to individual investors, each with its advantages, risks, and considerations. Common investment vehicles include stocks, bonds, mutual funds, ETFs, real estate, and alternative investments such as commodities or cryptocurrencies. When selecting investment vehicles, consider factors such as liquidity, diversification, fees, tax implications, and your investment objectives.

Stocks represent ownership stakes in publicly traded companies and offer the potential for capital appreciation and dividends. Bonds are debt securities issued by governments or corporations and provide fixed interest payments over a specified period. Mutual funds and ETFs pool investors’ money to invest in a diversified portfolio of assets, offering professional management and instant diversification. Real estate investments can generate rental income and property appreciation, while alternative investments provide opportunities for portfolio diversification and potentially high returns, though with higher risk.

Before investing in any vehicle, conduct comprehensive research and seek professional advice if needed to ensure that it aligns with your investment strategy and risk tolerance. Consider factors such as historical performance, fees, management quality, and regulatory oversight to make informed investment decisions that support your long-term financial goals.

Implementing Your Investment Plan

Choosing a Brokerage Account:

A brokerage account serves as a gateway to the financial markets, allowing you to buy and sell investments such as stocks, bonds, mutual funds, and ETFs. When selecting a brokerage account, consider factors such as fees, account minimums, investment options, trading platforms, research tools, and customer service. Compare brokerage companies to find one that offers the features and services that align with your investment needs and preferences. You must take your time here to make sure you have double checked the broker you intend to use.

Many brokerage firms offer commission-free trading on stocks and ETFs, making it more cost-effective for investors to build diversified portfolios without incurring excessive fees. Some brokers also provide educational resources, market analysis, and investment guidance to help investors make informed decisions. Additionally, consider whether you prefer a traditional full-service brokerage firm that offers personalized advice and portfolio management services or a discount brokerage firm that provides low-cost trading with minimal frills.

Researching Investments:

Before investing in any asset, it is indispensable to conduct thorough research to understand its fundamentals, risks, and potential returns. This is because not all asserts are traded the same way. Start by analyzing the company or asset’s financial statements, earnings reports, management team, competitive positioning, and industry trends. Evaluate factors such as revenue growth, profitability, debt levels, market share, and regulatory risks to assess the investment’s long-term prospects. I would like you to take each of these technical terms and search for them in relation to the asset you want to start investing in.

Consider using fundamental analysis, technical analysis, or a combination of both to evaluate investment opportunities and make informed decisions about your investment. The fundamental analysis focuses on the inherent value of an asset based on the asset’s underlying economic factors, while the technical analysis examines the historical price patterns and market trends or behavior to predict future price movements. Additionally, seek out independent research and expert opinions from reputable sources to appendage your analysis and gain a broader perspective on potential investments. The combination of the two market analyses is very helpful as opposed to choosing just one.

Monitoring and Adjusting Your Portfolio:

Investing is an ongoing process that requires regular monitoring and adjustment to ensure that your portfolio remains aligned with your financial goals and risk tolerance. Review your portfolio regularly to assess its performance, asset allocation, and individual investments. Monitor market conditions, economic trends, and geopolitical events that may impact your investments and adjust your portfolio accordingly. You can get this insight through fundamental analysis of the market.

Consider rebalancing your portfolio periodically to maintain your target asset allocation and reduce exposure to overvalued or underperforming assets. Using technical analysis indicators like RSI that can inform you as to when an asset is over-bought or over-sold can help you change the direction of your investment easily. Reallocate assets from outperforming sectors or asset classes to those that offer better value or growth potential. In addition, periodically review your investment strategy and financial goals to ensure that they remain relevant and adjust them as needed based on changes in your personal or financial circumstances.

Tax Considerations:

This particularly is helpful to people who live in countries where tax is taking effect on any asset. Tax efficiency is an essential aspect of investment planning, as taxes can significantly impact on your investment returns over time. Consider strategies to minimize taxes on your investment income, capital gains, and distributions. Take advantage of tax-advantaged accounts such as individual retirement accounts (IRAs), 401(k) plans, and health savings accounts (HSAs) to defer or avoid taxes on contributions and investment earnings.

When selecting investments, take into consideration their tax insinuations, such as dividend income, capital gains, and tax-deferred growth. Favor investments with lower turnover, qualified dividends, and long-term capital gains, which may be taxed at lower rates than ordinary income or short-term gains.

Consult with a tax advisor or financial planner to develop a tax-efficient investment strategy that aligns with your financial goals and minimizes your tax burden which of course may require you to pay her something small, but it will be worth it. By incorporating tax considerations into your investment plan, you can maximize your after-tax returns and keep more of your investment gains for yourself and not for the government.

Growing Your Wealth Over Time

The Power of Compounding:

Compounding is a powerful force that allows your investments to grow exponentially over time. It involves earning returns not only on your initial investment but also on the accumulated earnings from previous periods. As your investment grows, the returns generated by your investment also increase, leading to accelerated growth over time. The key to harnessing the power of compounding is to start investing early and regularly contribute to your investment portfolio to maximize the effect of compounding over the long term.

For example, suppose you invest $1,000 in a stock that earns an average annual return of 8%. After one year, your investment grows to $1,080. In the second year, you earn returns not only on your initial $1,000 but also on the $80 of earnings from the first year. Over time, compounding can significantly amplify the growth of your investments, allowing you to accumulate wealth and achieve your financial goals faster. Note you keep on withdrawing the returns on your investments each year, your investment will not compound, and this can retard your financial growth. That is why the next three points are very crucial.

Reinvesting Dividends and Returns:

Dividends are a form of passive income paid by companies to their shareholders as a reward for owning their stock. Instead of cashing out dividends, consider reinvesting them into your investment portfolio to purchase additional shares of stock. Reinvesting dividends allows you to take advantage of the power of compounding by accelerating the growth of your investment over a period.

Similarly, consider reinvesting any capital gains or investment returns into your portfolio rather than withdrawing them for personal use. By reinvesting returns, you can compound your earnings and maximize the growth potential of your investments. Over time, even small reinvestments can have a significant impact on the value of your investment portfolio and help you achieve your long-term financial goals.

Dollar-Cost Averaging:

Dollar-cost averaging is an investment strategy that involves investing a fixed amount of money at regular intervals, regardless of market fluctuations, something like fixed deposit savings. By investing consistently over time, you can reduce the impact of market volatility and potentially lower your average cost per share. Dollar-cost averaging allows you to buy more shares when prices are low and fewer shares when prices are high, smoothing out the overall cost of your investments.

For example, suppose you invest $100 in a mutual fund every month. If the price of the mutual fund is $10 per share, you will purchase ten shares in the first month. If the price drops to $5 per share in the second month, you will purchase twenty shares with the same $100 investment. Over time, dollar-cost averaging can help you build a diversified investment portfolio and take advantage of market fluctuations to maximize your returns.

Staying Disciplined and Patient:

Building wealth through investing requires discipline and patience. Resist the temptation to make impulsive decisions based on short-term market fluctuations or emotional reactions. Instead, focus on your long-term financial goals and stick to your investment plan through market difficulties. Remember that investing is a marathon, not a sprint, and success often requires staying on the course and remaining committed to your strategy over time.

Avoid trying to time the market or chase hot investment trends, as this can lead to costly mistakes and underperformance. Instead, maintain a diversified portfolio of high-quality investments and focus on factors that you can control, such as asset allocation, risk management, and regular contributions. By staying disciplined and patient, you can weather market volatility and capitalize on long-term investment opportunities to gain experience to grow your wealth steadily over time.

Advanced Strategies for Wealth Accumulation

Real Estate Investments:

Investing in real estate can be an effective way to diversify your investment portfolio and generate passive income. Real estate investments offer several advantages, including potential appreciation in property value, rental income, tax benefits, and portfolio diversification. There are many ways to invest in real estate, including purchasing rental properties, investing in real estate investment trusts (REITs), crowdfunding platforms, or real estate partnerships.

When investing in real estate, conduct thorough due diligence to assess the property’s location, condition, rental potential, and market trends. Consider factors such as property taxes, maintenance costs, vacancy rates, and potential rental income to determine the feasibility of the investment. Additionally, be aware of the risks associated with real estate investing, such as liquidity constraints, market fluctuations, and regulatory changes.

Retirement Accounts:

Retirement accounts are tax-advantaged investment vehicles designed to help individuals save for retirement. Common types of retirement accounts include 401(k) plans, individual retirement accounts (IRAs), Roth IRAs, and SEP IRAs. Contributions to these accounts may be tax-deductible or grow tax-deferred, allowing your investments to compound over time without being subject to immediate taxes.

Maximize your contributions to employer-sponsored retirement plans such as 401(k) or 403(b) plans, especially if your employer offers matching contributions. Take advantage of catch-up contributions if you are over the age of fifty to accelerate your retirement savings. Additionally, consider opening an IRA or Roth IRA to supplement your employer-sponsored retirement savings and diversify your tax exposure in retirement.

Tax Optimization:

Tax optimization strategies can help maximize your after-tax returns and minimize your tax liability on investment income and gains. Consider strategies such as tax-loss harvesting, where you sell investments at a loss to offset capital gains and reduce your tax bill. Additionally, consider investing in tax-efficient investment vehicles such as index funds or ETFs, which tend to have lower turnover and generate fewer taxable distributions.

Take advantage of tax-advantaged accounts such as health savings accounts (HSAs) or 529 college savings plans to save for healthcare expenses or education costs while enjoying tax benefits. Consider consulting with a tax advisor or financial planner to develop a tax-efficient investment strategy that aligns with your financial goals and minimizes your tax burden over time.

Seeking Professional Advice:

While DIY investing can be rewarding, seeking professional advice from a financial advisor or investment professional can provide valuable guidance and expertise, especially for complex financial situations or advanced investment strategies. A financial advisor can help you develop a personalized investment plan tailored to your unique goals, risk tolerance, and time horizon.

When selecting a financial advisor, consider factors such as their credentials, experience, fee structure, investment philosophy, and fiduciary duty to act in your best interest. Choose an advisor who takes the time to understand your financial situation and communicates clearly and transparently about fees, risks, and potential outcomes. By working with a trusted advisor, you can gain confidence in your investment decisions and navigate the complexities of the financial markets with greater peace of mind.

References

- https://www.forbes.com/advisor/investing/real-estate/

- https://www.irs.gov/retirement-plans/retirement-plans-faqs

- https://www.thebalance.com/tax-smart-ways-to-grow-your-wealth-4799646

- https://www.nerdwallet.com/article/investing/how-to-choose-a-financial-advisor

- https://www.cnbc.com/2023/02/15/the-power-of-compound-interest-how-it-works-examples-and-more.html

- ttps://www.fool.com/investing/how-to-reinvest-dividends-and-why-its-important/

- https://investor.vanguard.com/investing/dca-drip

- https://www.schwab.com/resource-center/insights/content/staying-the-course-the-key-to-long-term-investing-success

- https://www.nerdwallet.com/article/investing/how-to-choose-an-online-broker

- https://www.morningstar.com/learn/how-to-research-stocks

- https://www.fidelity.com/learning-center/investment-products/mutual-funds/portfolio-rebalancing

- https://www.investopedia.com/terms/t/tax-efficient-investing.asp

- https://investor.vanguard.com/investing/how-to-invest/asset-allocation

- https://www.schwab.com/resource-center/insights/content/the-importance-of-diversification

- https://www.sec.gov/reportspubs/investor-publications/investorpubsmfintrohtm.html

- https://www.forbes.com/advisor/investing/beginners-guide-real-estate-investing/

- https://www.nerdwallet.com/article/finance/how-to-build-a-budget

- https://www.thebalance.com/how-to-build-an-emergency-fund-5194523

- https://www.daveramsey.com/blog/how-the-debt-snowball-method-works

- https://www.experian.com/blogs/ask-experian/credit-education/basics/

- https://www.investopedia.com/terms/i/investing.asp

- https://www.thebalance.com/understanding-investment-risk-4171066

- https://investor.vanguard.com/investing/goals

- https://www.cnbc.com/2022/07/05/why-you-need-a-long-term-investment-strategy.html

The degree of my fascination with your creations is equal to your own enthusiasm. The sketch is tasteful, and the authored material is of a high caliber. Yet, you appear uneasy about the prospect of heading in a direction that could cause unease. I’m confident you’ll be able to resolve this situation efficiently.